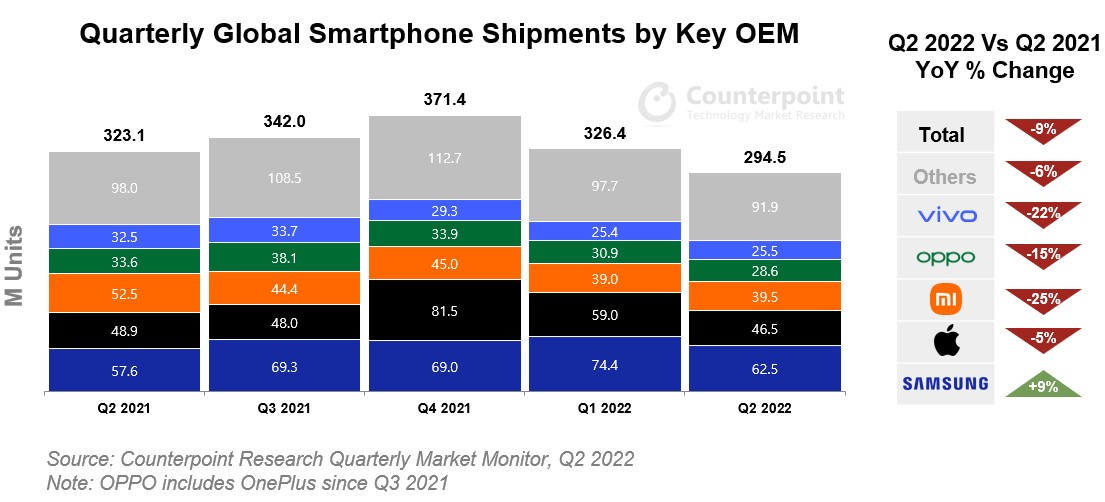

“After a brief rebound in 2021, the global smartphone industry is experiencing a second period of plummeting shipments, and the unexpected reduction in demand is affecting the main suppliers,” stated Canalys Research Analyst Runar Bjrhovde. “Despite a 6% yearly increase, Samsung’s shipments plummeted 16% from the previous quarter as the vendor battled unhealthy inventory levels, particularly in the mid-range.” Samsung is promoting aggressive price methods and strong advertising for its low-end A series, utilising cost-effective ODM manufacture to generate mass-market consumer demand.

Due to a number of lockdowns throughout the quarter, Chinese OEMs continued to haemorrhage. According to the research, Oppo’s market share declined from 11% to 10%, while Vivo’s market share decreased from 10% to 9%, and Xiaomi’s market share decreased from 17% to 14%. Looking ahead, the difficulties are expected to persist for the remainder of the year. A bleak economic growth prognosis, with many nations on the verge of recession, continued and protracted geopolitical uncertainty, rising commodity costs, and dwindling consumer desire for electronic products are all hurdles to the smartphone industry’s post-COVID recovery.